Interest Rates Continue to Rise

August 16, 2023 by Laura Duggan · Leave a Comment

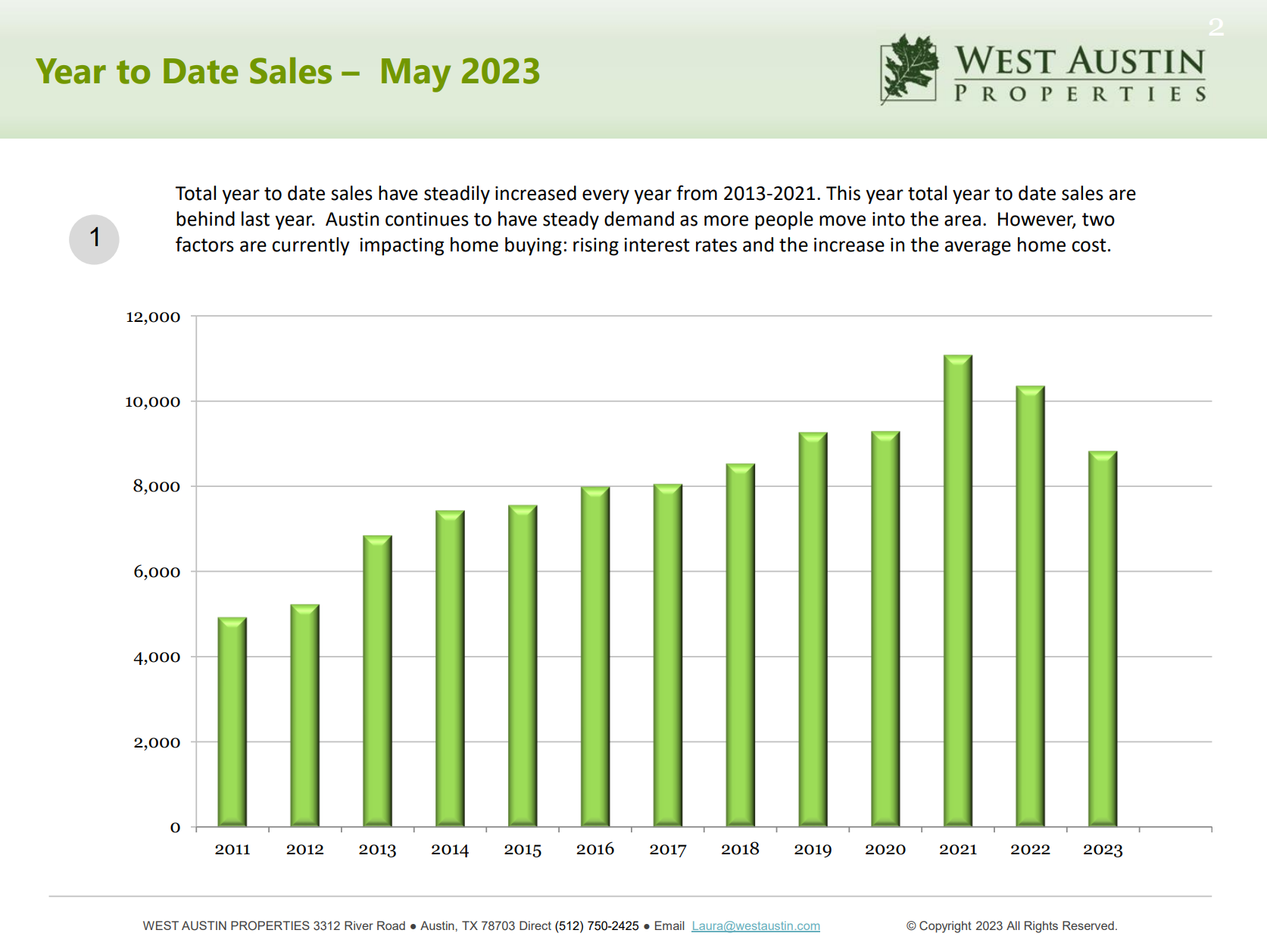

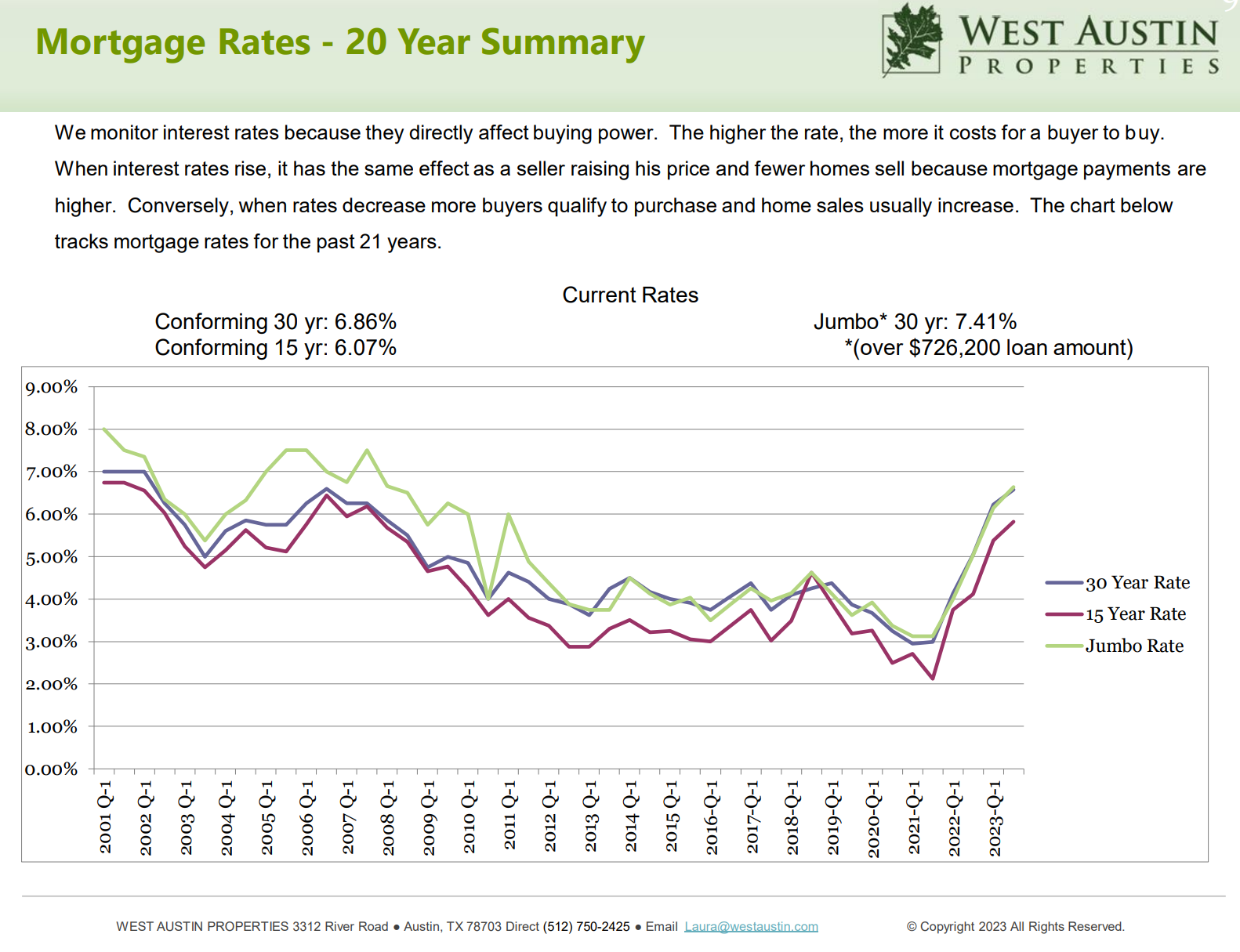

Mortgage interest rates have risen 11 times since March, 2022. Each time the rate increases, it raises the price of a home to a home buyer. Take a historical look at the rise and fall of rates.

For a comprehensive look at how the rates are affecting home prices and sales by zip code and price band, take a look at our monthly Market Report.

Laura Duggan, Broker, West Austin Properties, 3312 River Road, Austin, TX 78703, 512-750-2425

Austin Market June 2023

June 28, 2023 by West Austin Properties · Leave a Comment

To understand the Austin residential market, it is important to look at the difference in median closed values over the prior two years.

- In June of 2021, the median home closed price was $398,000.

- In June of 2022, the median home closed price was $550,000, an increase of 38% in one year.

- Then interest rates started to increase, companies began laying off some workers and investors who had been active in the market experienced declining values and expenses increasing.

- During the next 10 months, prices began dropping and by March 2023, the median residential home sold for $442,250, a 10 month decline of 27%.

- March 2023 was the low point for median close prices.

- Since March, by the end of May, home values have increased to $465,000 or an increase of 5% over March 2023.

- Current median home closed prices are approximately where closed prices were in June 2021, two years ago.

- Median home closed prices have been increasing each of the last two months, however these value are still 15% below the highs of June 2022, one year ago.

- Current median homes closed prices would need to increase 18.3% to reach the June 2022 levels.

Where is the Austin Real Estate Market Now?

September 30, 2022 by Laura Duggan · Leave a Comment

After over a year of an Extreme Seller’s Market (See Market Report Tab above) where there were fewer than 2,000 homes for sale and prices rose substantially, it all changed in May. There are now over 9,000 homes for sale, interests rates have risen 3.5 percent to just under 7%, inflation has increased the cost of goods and services and home values are leveling off or slightly declining.

What does the future hold for the Austin Real estate market?

According to economist and native Austinite, Mark Sprague, the State Director of Information Capital with Independence Title Company, the Austin real estate market remains one of the most robust in the country, primarily because of increasing job opportunities and people and companies moving to Austin.

According to Mark Sprague:

* Average interest rates will increase to 6.5 to 7.5% over the

next year, and stabilize at the 50 year average of of 7.4%

* The US will go into recession, following Europe and China, that

will last 3-5 years.

* Austin will continue to have consistent housing demand,

however Austin is critically short of homes on the market to

meet the demand and he predicts inventory will decrease 10 to

15% next year. Because Austin rents have gone up over 22%

in the last year, there will be an increase in demand for the

purchase of homes.

* Because the cost of materials have risen between 10 and 50%,

new homes will continue to cost more.

* Current homes values may decline slightly, however they will

increase in the Spring when our demand is traditionally higher.

Mark Sprague’s basic recommendation: Buy now as time will only

cost a buyer more. Austin is not slowing down.

For sellers, homes have to be presented extremely well and priced correctly. He said, “if your house does not sell in 30 days, you have missed getting the most value for your house and should lower the asking price.” Our experience tells us that you should price a house competitively and let the market set the sales price. If you have to reduce the price, buyers will generally ask for a further reduction. Price it to sell so that you avoid having to make reductions.

In this rapidly changing market, extensive experience in real estate is critical to evaluate the “the right price.” If you are a buyer in today’s market, you may pay a little more in interest rate but you likely won’t be competing with other buyers driving the price up. Interest is still the best tax deduction we have, and the loan can always be refinanced when the rate drops. If you are a seller, setting the right price the first time is key in getting top of the market pricing. We can help you figure out how to position the condition and price just right to make it an attractive buy.

As always, real estate is hyper local even by neighborhood. Let us know when it is time for you to make your next move.

Submitted by Laura Duggan, Broker, West Austin Properties, laura@westaustin.com, 512-750-2425.